Rivian, an electric vehicle (EV) manufacturer, has captured significant attention in the automotive industry for its innovative approach to electric mobility. However, like any company in a dynamic market, there are occasional speculations and concerns about its financial health.

This article aims to provide a comprehensive examination of the current state of Rivian and address the question: Is Rivian going out of business? The short answer is no, Rivian is successfully operating and introducing new models as the need of time. Lets dive deep in to details about Rivian.

Background on Rivian:

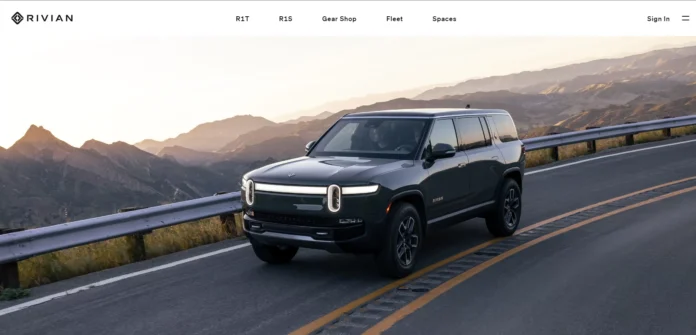

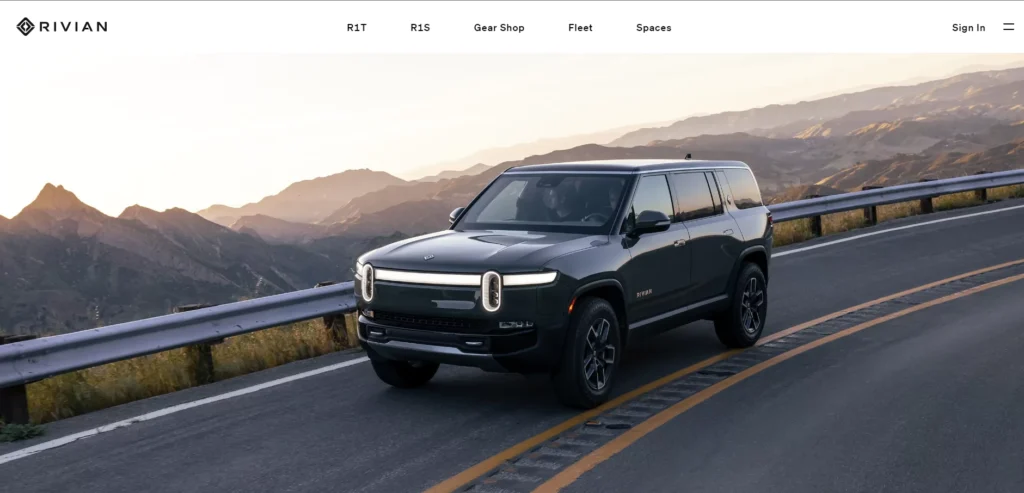

Founded in 2009, Rivian has emerged as a prominent player in the electric vehicle market, gaining recognition for its electric trucks and SUVs. The company’s R1T pickup truck and R1S SUV have generated excitement among consumers and investors alike. Rivian’s approach to blending electric technology with off-road capabilities has positioned it as a key player in the EV landscape.

The Current Financial Landscape:

As of the last available information, there is no credible evidence to suggest that Rivian is on the brink of going out of business. The company has undergone significant developments, including successful fundraising rounds and strategic partnerships that reflect a positive outlook.

1. IPO Success:

- Rivian went public in November 2021, launching one of the most significant initial public offerings (IPOs) in the automotive industry. The IPO raised substantial capital for the company, demonstrating investor confidence in Rivian’s potential.

2. Market Capitalization:

- Rivian’s market capitalization, as reflected in its stock price, has been substantial, positioning it as one of the most valuable EV companies. While stock prices can fluctuate, Rivian’s market capitalization is indicative of strong market interest.

3. Strategic Partnerships:

- Rivian has formed strategic partnerships with major companies, including Amazon and Ford. These partnerships involve collaboration on electric delivery vans and the integration of Rivian’s technology into Ford’s electric vehicles. Such partnerships strengthen Rivian’s position in the market and enhance its revenue streams.

4. Production and Deliveries:

- Rivian has ramped up production and initiated deliveries of its R1T pickup trucks and R1S SUVs. The successful delivery of vehicles to customers is a crucial milestone for any automaker and demonstrates the company’s ability to fulfill orders.

Factors Contributing to Speculations:

While Rivian’s recent achievements are notable, there are factors contributing to speculations about its financial health. It’s essential to examine these factors to gain a comprehensive understanding.

1. Market Volatility:

- The stock market, including the EV sector, can experience volatility. Fluctuations in stock prices may lead to speculations, but they do not necessarily reflect the long-term viability of a company.

2. Competitive Landscape:

- The electric vehicle market is highly competitive, with established players and new entrants vying for market share. While Rivian has made significant strides, competition and market dynamics can influence perceptions.

3. Investor Expectations:

- High investor expectations can sometimes lead to market reactions that may not align with a company’s immediate financial performance. Managing expectations and delivering on long-term goals is crucial for sustained success.

Rivian’s Response and Future Outlook:

1. Investor Communications:

- Rivian has actively communicated with investors, providing updates on production, deliveries, and future plans. Transparent communication is a positive sign of a company’s commitment to its stakeholders.

2. Continuous Innovation:

- Rivian’s focus on innovation and commitment to advancing electric vehicle technology is evident in its vehicle designs and features. Continued innovation can contribute to the company’s competitiveness in the market.

3. Diversification of Offerings:

- Rivian’s portfolio includes a range of electric vehicles, and the company has plans to expand its product offerings. Diversification allows Rivian to address various market segments and consumer preferences.

4. Long-Term Strategy:

- Companies in dynamic industries often operate with a long-term perspective. Rivian’s strategic initiatives, partnerships, and investments suggest a commitment to building a sustainable and successful business over time.

Conclusion:

As of the latest available information, there is no credible evidence to support the claim that Rivian is going out of business. The company’s recent achievements, strategic partnerships, successful IPO, and production milestones indicate a positive trajectory. While speculations may arise due to market dynamics and competitive pressures, it’s crucial to assess a company’s financial health based on comprehensive information.

Investors, stakeholders, and enthusiasts should monitor Rivian’s performance, market developments, and the electric vehicle industry as a whole. As with any investment, there are inherent risks, and individuals should make informed decisions based on a thorough understanding of the company’s fundamentals and long-term prospects.

The electric vehicle sector is evolving rapidly, and Rivian’s role in shaping the future of sustainable mobility positions it as a key player in the industry. Time will reveal the full extent of Rivian’s success, but current indicators suggest a company actively working toward a future marked by innovation, growth, and continued contributions to the electric vehicle revolution.